Health Savings Account (HSA) ONLY for the Cigna HSA $6,350 Plan

If you enroll in the Cigna HSA $6,350, you are eligible to establish a health savings account (HSA).

What is a Health Savings Account? 7 basic rules of an HSA you need to know

An HSA is a type of bank account that you may set up and use to pay for eligible health care expenses with pre-tax payroll deductions. Employees are only eligible to enroll and contribute into an HSA account if the Qualified High Deductible Health Plan is elected. You may access funds via a debit card. Our HSA provider is through HSA bank.

This account is portable and the funds do not expire.

The contributions from all sources may not exceed the annual maximum allowed by the IRS or it will be subject to income tax. The maximum allowed annual contributions for 2025 are:

Single: $4,300

Family: $8,550

$1,000 Catch up Contributions for Employees and Spouses ages 55+

Fireclay Tile will fund $40 per month up to $480 annually toward your HSA plan

Each pay period, you may contribute pre-tax dollars to your account. Whether or not you make a contribution, if you have selected any coverage other than employee only, Fireclay Tile will make the incremental contribution to your account each pay period as long as you actively participate in the Cigna HSA $6,350 medical plan. Fireclay Tile will help fund your account with $480 ($40 per month) over a one-year period.

To get reimbursed for out-of-pocket HSA expenses, you’ll need to log into your WEX account. Click here to view instructions step-by-step.

WEX Inc Support: 866-451-3399

Advantages of an HSA

Tax advantages: As long as you use the account for qualified health care expenses, FCT contributions and yours are exempt from federal and, in most cases, state income taxes, as well as Social Security taxes.

Can be used in the future : Unlike a health care flexible spending account (FSA), unused funds in your HSA at the end of the year remain in your account to pay for future health care expenses.

Portability : You can take all the money in your account with you if you change employers or retire. Once you retire, you can use any of your HSA funds to pay medical expenses tax-free.

Flexibility : You can update your payroll deductions at any time.

To learn more about what is deemed as an eligible expense, click the button below and scroll down to “What Medical Expenses are Includible?”

An HSA Consideration (15 min) Presentation now available for you to review! An HSA is a tax-advantaged savings account that you can use for medical dental and vision expenses that are not covered by your insurances. Unlike a FSA, the money never expires. We invite you to watch this presentation which has in-depth information on the benefits of HSA. It includes information on qualified expenses, contribution limits, savings, and investment opportunities, etc.

Flexible Spending Accounts (FSA)

The FSAs, administered by WEX, offer you a way to save money on eligible health care and dependent care expenses. When you enroll in one or both accounts, you choose an amount to be deducted from each paycheck before federal, Social Security and most state income taxes are calculated. Because the money you put into FSAs is contributed on a before-tax basis, you lower your taxable income, which saves you money. Just be sure to use up your account balance by Dec. 31, 2025.

To get reimbursed for out-of-pocket FSA expenses, you’ll need to log into your WEX account. Click here to view instructions step-by-step.

The annual contribution limit is rising to $3,300 in 2025, up from $3,200 in 2024. If the employer’s plan permits the carryover of unused health FSA amounts, employees can carry over up to $660 in 2025. That’s up $20 over the 2024 carryover amount, which is $640.

You must re-enroll in the FSAs each year that you wish to participate, even if you are currently participating. If you do not re-enroll, you will be assigned a $0 contribution rate.

For questions on FSA Medical Claims, please call WEX at 1-866-451-3399.

Flexible Spending Account - Medical

This program lets employees pay for certain IRS-approved medical, dental and vision care expenses and prescriptions not covered by their insurance plan with pretax dollars. Expenses can be incurred by you or any dependent you claim on your federal income tax return — your spouse, your unmarried children or even a dependent parent. You don’t have to be enrolled in a health plan to use the account. Your monthly funds will be available on your WEX debit card in full on the first of the month to use. There are limits on contributions to a health FSA offered under a cafeteria plan, which in 2025 is $3,300. This plan resets each year. Any unused funds (aside from $660 rollover) will be forfeited at the end of the policy period.

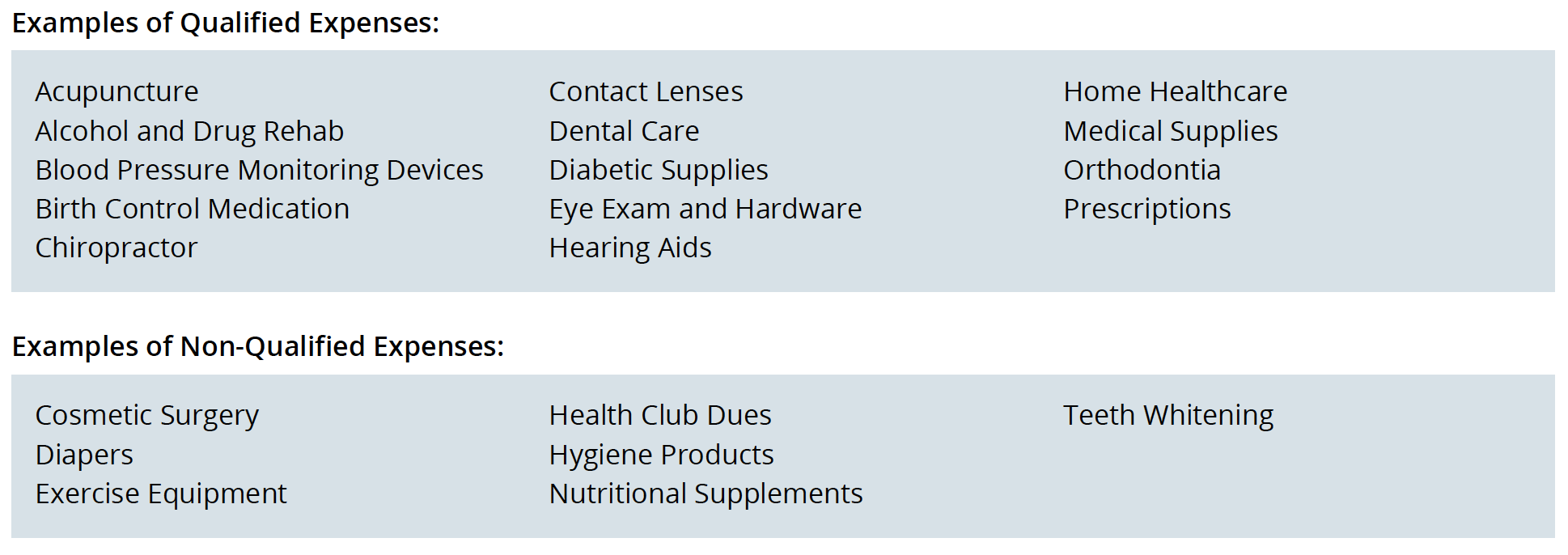

Some examples of eligible expenses include:

Hearing services, including hearing aids and batteries

Vision services, including contact lenses, contact lens solution, eye examinations and eyeglasses

Dental services and orthodontia

Chiropractic/Acupuncture services

Download IRS publication 502 for more information about FSAs and eligible health care expenses:

If you are enrolled in the Cigna HSA $6,350 you cannot contribute to the Medical FSA.

Flexible Spending Account - Dependent Care

The Dependent Care FSA lets employees use pre-tax dollars toward qualified dependent daycare expenses that they incur in order to go to work or look for work, as long as your spouse, if you are married, also works, is a full-time student or is disabled. The annual maximum amount you may contribute to the Dependent Care FSA is $5,000 (or $2,500 if married and filing separately) per calendar year. Examples include:

The cost of child or adult dependent care, in or out of your home

Nursery schools and preschools (excluding kindergarten)

Get reimbursed for out-of-pocket expenses:

Paid out of pocket for something that's covered by your FSA? Submit a claim and receive a reimbursement, by logging into Paycor, go to the Flexible Spending Account tab, click “Submit Claim” and enter information.

Changing your FSA after a Qualifying Life Event (QLE)

If an employee has gone through a qualifying life event (QLE) and would like to enroll in a Flexible Spending Account (FSA), they should contact their benefits administrator.

Generally, FSA contribution changes due to a QLE must reflect the nature of the event. For example:

If an employee’s dependent turns 26, it would be acceptable for the employee to decrease their FSA contribution to reflect the loss of a dependent.

If an employee adopt a baby, they may want to increase their elections to accommodate the new medical expenses and/or day care costs for the new family addition.

If an employee gets married, they may want to increase their elections to accommodate the new medical expenses for their spouse.

If an employee’s spouse loses their job (and therefore loses coverage), it would be acceptable for the enrollee to increase their FSA contribution (or sign up for the first time).

Unacceptable changes

An example of an unacceptable change is employee who wants to reduce their Child & Elderly Care FSA contributions after the birth of a child. Though birth is a QLE, the reduction is not consistent with the QLE.